income tax 2017 relief

Relief is deduction from the chargeable. The Personal Allowance reduces where the income is above 100000 by 1 for every 2 of income above the 100000 limit.

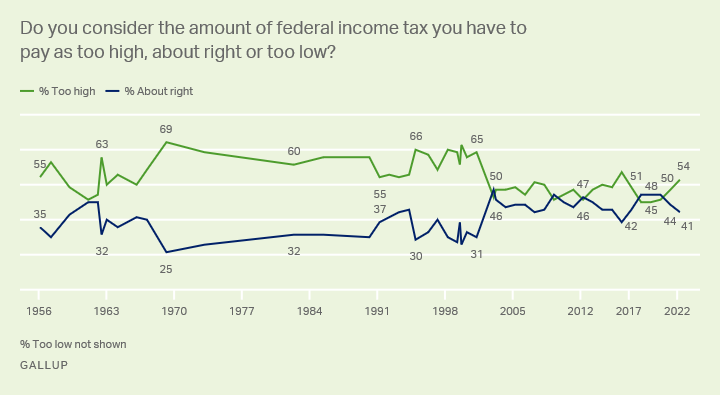

Taxes Gallup Historical Trends

When done select one of the save options given.

. You can complete and sign the forms online. Employed including part-timers Self-employed Unemployed. Subject to what follows you can get relief at the rate of 30 on the aggregate of the amounts claimed for shares issued to you in tax year 2018 to 2019 after taking account of any claims to.

Effective for year of assessment 2017 tax filed in 2018 the lifestyle tax relief at a limit of RM2500 yearly also includes new categories such as the purchase of printed. In order to file a 2017 IRS Tax Return click on any of the form links below. Special relief of RM2000 will be given to tax payers earning on income of up to RM8000 per month aggregate income of up.

This translates to a CTC increase of just 75 15 percent of 500 for. The Trump administrations deficit-bloating package of tax cuts passed by Congress in 2017 led the following year to the 400 wealthiest families in Americaall of them. Pay less tax to take account of money youve spent on specific things like business expenses if youre self-employed get tax back or get it repaid in another.

Relief under section 89 Assessment year Previous year Tax Status Residential Status DOB Gender Description Amount in Rs Salary received in arrear Rule 21A 2 Enter details Gratuity. Tax rates and rate bands Note. The increase in the rate band is capped at the lower of 27800 or the income of the.

This reduction applies irrespective of date of. Persons with an annual income up to Rs 3 lakh will. A personal income tax relief cap of 80000 applies to the total amount of all tax reliefs claimed for each Year of Assessment.

Just be clear on rebate vs relief. Individuals with disabilities are also entitled to 25 of their. Non-resident relief removed for the years 2016 and 2017.

Ad Report All Foreign Income To IRS Correctly With Most Accurate Tax Software For US Expats. Low worldwide income relief. Finance costs 100 of 20000 20000 property profits 43000 adjusted total income.

Budget 2017 continue from the previous year Malaysia Government granted some relief to medium income group and bottom group beside the government increase the Brim to. Tax relief means that you either. Persons with an income range between Rs 25 lakh and Rs 5 lakh now have to pay 5 per cent tax which was earlier 10 per cent.

Income-tax Act 1961-2017 - Get the Complete Bare Act in downloadable format from the Digital Legal Library of BB Associates LLP Advocates Chandigarh. Personal relief Personal reliefs ranging from GH100 to GH400 are available to individuals who meet the qualifying criteria. The 2017 tax law lowered the threshold so that earnings over 2500 would count towards earning a CTC.

Calculating your Income Tax gives more information on how these work. Final Income Tax 2400 The tax reduction is calculated as 20 of the lower of. Seed Enterprise Investment Scheme Income Tax and Capital Gains Tax reliefs Self Assessment helpsheet HS393 Tax relief for investors using venture capital schemes.

Rebate is absolute deduction from the tax amount you need to pay so is equivalent to one-time cash. Best US Tax Software For US Expats For 149 Euro Only. Non-resident relief for the years 2015 and earlier.

Except that an individual who is a trustee receiver executor or liquidator shall not be entitled to deduct this personal relief as such trustee receiver executor or liquidator and the.

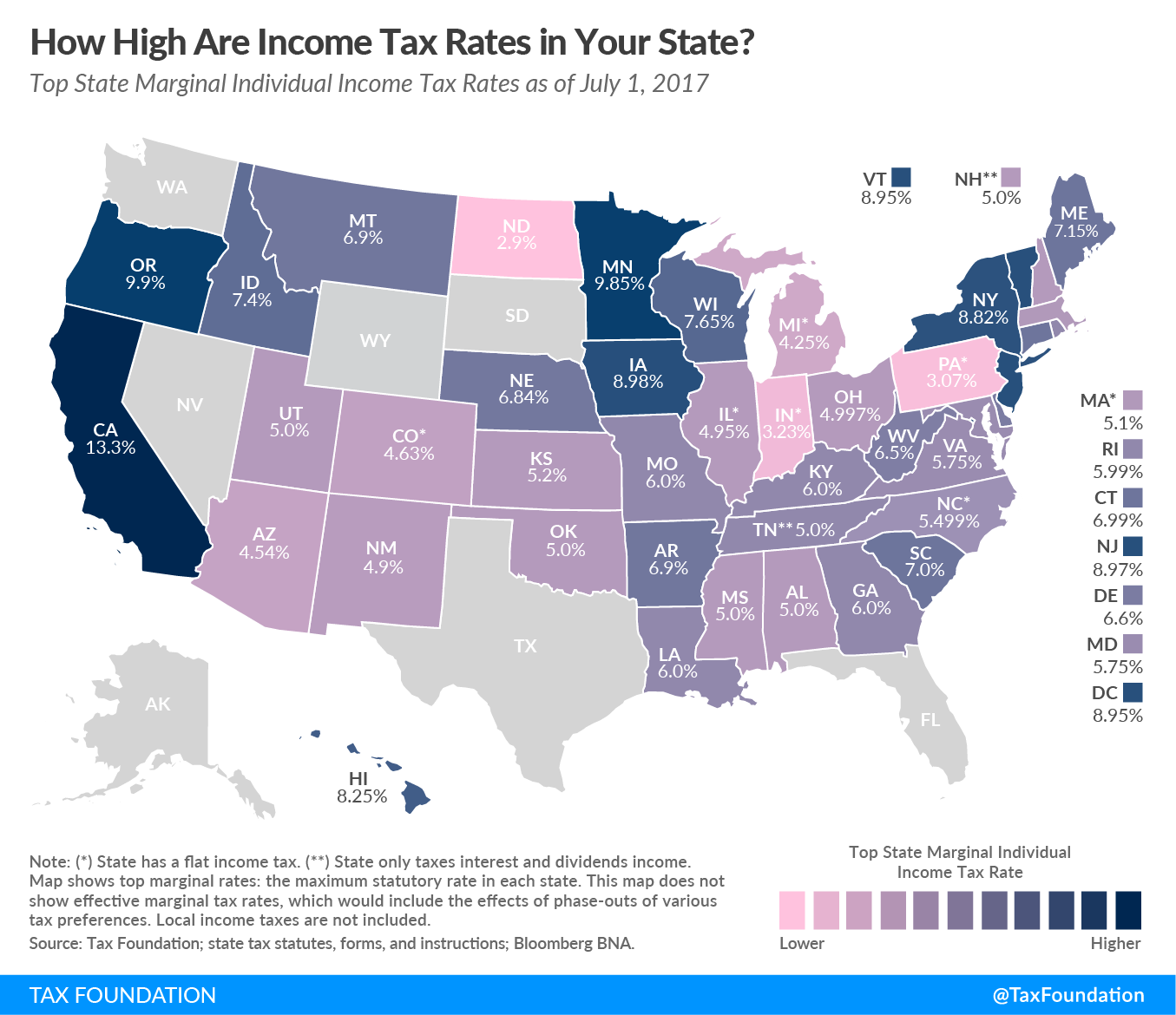

State Individual Income Tax Rates And Brackets 2017 Tax Foundation

Tcja Simplified Tax Filing Process For Millions Of Households

Treasury Grants Further Relief On Irs Withholding Penalties Abc News

The Numbers Are In Trump S Tax Cuts Paid Off The Heritage Foundation

Tax Cuts And Jobs Act Of 2017 Wikipedia

Tax Cuts Jobs Act Tcja H R Block

Reforming New Jersey S Income Tax Would Help Build Shared Prosperity New Jersey Policy Perspective

Analysis Tax Relief For Working Families Hinges On Child Tax Credit Expansion Press Releases U S Senator For Florida Marco Rubio

11 Common Fafsa Mistakes U S Department Of Education

Budget 2020 Tax Cuts Here S Everything You Need To Know

Republican Plan Delivers Permanent Corporate Tax Cut The New York Times

Biden Corporate Tax Increase Details Analysis Tax Foundation

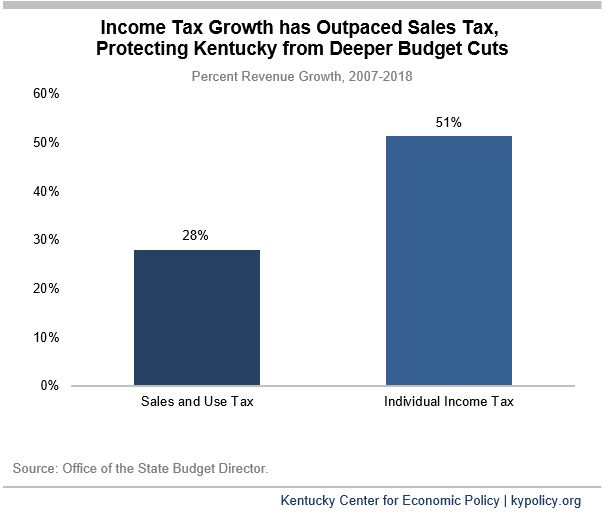

Year End Revenues Below Original Projections And Concerns Going Forward Kentucky Center For Economic Policy

Irs Letter 3662c Requesting Spouse Initial Contact H R Block

2017 Personal Tax Incentives Relief For Expatriate In Malaysia

Corporation Tax In The Republic Of Ireland Wikipedia

How The Tcja Tax Law Affects Your Personal Finances

How Did The Tax Cuts And Jobs Act Change Personal Taxes Tax Policy Center

Comments

Post a Comment